29 Nov ELECTRIC SCOOTER ACCIDENTS, INSURANCE AND MORE

It’s great fun. You whizz along with the wind in your hair, maybe with a passenger riding pillion, a great way to get from A to B and a good value means of transport. No wonder electric scooters are hot right now. They’re convenient, affordable, fast and fun, and more of us are sharing rides on them every day, right around the world. In fact scooters represent a quiet transport revolution.

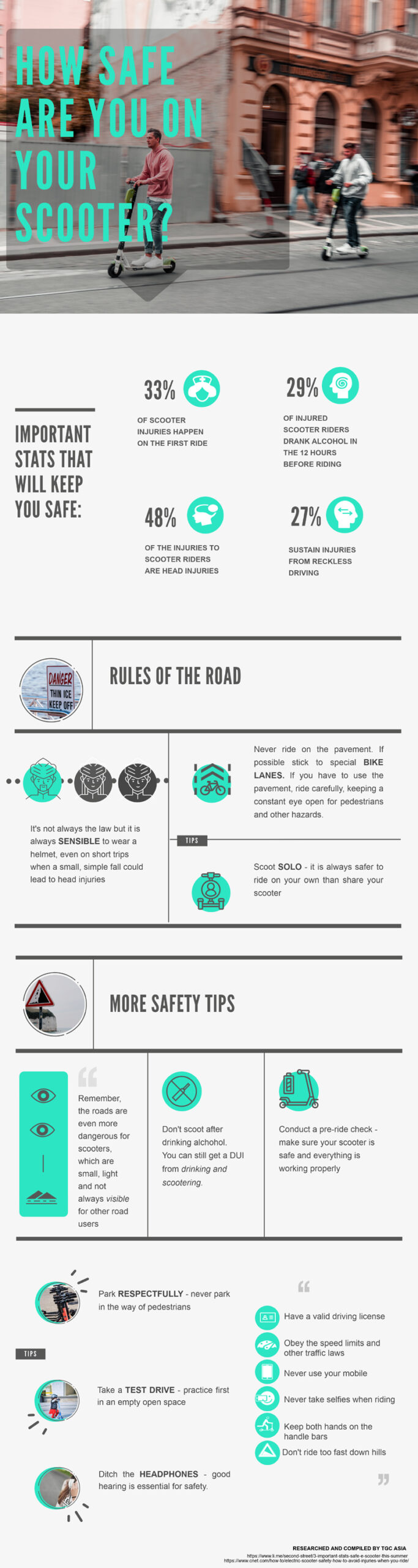

At the same time as being fun, scooters are dangerous. The world is seeing fast-increasing numbers of injuries, road traffic accidents and even deaths as the electric scooter becomes more commonplace than ever on our streets and roads.

The danger has serious insurance implications. As an electric scooter rider are you exposing yourself to liability or are you insured for the damage you can cause to yourself, other people, their property, and your scooter itself?

INSURANCE AND ELECTRIC SCOOTERS

The gaps you need to fill

If you’re fortunate enough to have a personal health insurance policy and cause damage on your scooter, the cover might help cover the cost of your own medical bills. But if you injure someone else, what then? What if you drive into a pedestrian, damage someone’s property or cause a road accident? Most standard insurance policies won’t pay out.

If you’ve hired an electric scooter your hire firm might have placed the responsibility for accidents on you as the rider, something you agreed to at the start of the hire period. Some scooter hire firms offer liability coverage for claims, but it’s hard to tell whether a claim is valid until the investigations are complete, which is not much good for you and your finances.

The worldwide boom in ride-sharing and ride-hailing have made things even more complicated. While you might think your auto insurance covers an electric scooter accident, automobile insurance doesn’t usually cover vehicles with fewer than four wheels, and while your traditional home owners cover probably includes accidents on bicycles, it’s unlikely to cover motorised scooters.

HOW CAN SCOOTER RIDERS PROTECT THEMSELVES?

Scooter rentals in some places have created the need for new lanes in city roads, and a dramatic increase in scooter use in some cities comes with serious insurance implications for consumers, city officials and insurance companies alike.

Your first stop for scooter insurance is your insurance intermediary. You might be able to add special cover to your existing homeowner’s or renter’s insurance policy, a so-called ‘umbrella policy’ that covers more risks and has higher limits. Some insurers are beginning to provide electric scooter driver’s liability for damages they cause, with every claim investigated on it’s own unique merits. Your scooter might even be included under a special ‘recreational vehicles’ category.

Shared electric scooters are becoming so popular that insurers in some countries are providing shared mobility options for the first time. The Israeli insurer Voom provides on-demand insurance for drone operators in the USA, and it’s about to roll out insurance for electric scooters on a flexible per ride basis.

If a scooter rider causes a car crash, they could be badly injured and still be responsible for fixing damage to the car they crashed into. If the rider injures a pedestrian, they could be held responsible for the pedestrian’s medical bills, lost wages, and any pain and suffering. Because so many electric scooter riders, shared and otherwise, are riding a scooter for the first time, the chance of an injury or accident is pretty high right now. No wonder there have been so many reports of accidents on motorised scooters.

UNDERSTANDING YOUR SCOOTER INSURANCE CHOICES

Scooter insurance varies depending on the carrier and the country you’re in. It usually covers damages resulting from a collision. A liability element protects your finances against damage you do to others or their property, and a medical element protects your bank account against medical costs.

ARE YOU A SCOOTER RIDER?

If you ride a scooter and want to check you’re properly covered by insurance, we can help you with good advice and good value, high quality insurance products.